Top news and market moversthis week

SEBI proposes major reforms to reduce mutual fund costs

SEBI, India’s market regulator, has proposed several key changes to make mutual fund investing more transparent and investor-friendly. The main focus is on simplifying expense structures and removing unnecessary costs that currently burden investors. One of the major recommendations is to eliminate the extra 5 basis points (BPS — where 1 BPS equals 0.01%) that fund houses charge for distribution expenses. To offset this change, SEBI plans to slightly increase the overall expense ratio limit by 5 basis points in the initial slabs.

SEBI has also suggested that statutory taxes such as Goods and Services Tax (GST), Securities Transaction Tax (STT), Commodity Transaction Tax (CTT), and stamp duty be kept outside the total expense ratio (TER). This means any change in government tax rates will directly impact investors rather than being absorbed into fund management costs.

In addition, SEBI aims to lower brokerage and transaction charges to make trading more cost-efficient. Brokerage fees on cash market transactions could be reduced from 12 basis points to 2 basis points, and for derivatives, from 5 basis points to 1 basis point.

These reforms are designed to ensure more fairness, transparency, and cost efficiency, ultimately building greater investor trust and participation in India’s mutual fund ecosystem.

IPOs

Subscriptions for Lenskart Solutions Ltd.’s IPO went live on October 31, 2025, and will be accepted until November 4, 2025. The IPO received a good amount of investor interest by the conclusion of the first day, with an overall subscriber count of 1.13 times. Retail investors subscribed 1.32 times, while QIBs booked 1.42 times. Conversely, 0.41 subscriptions were made by (NIIs). The positive initial reaction shows that the market is optimistic about the company’s high brand recognition and prospects in the eyewear sector.

Studds Accessories Ltd IPO: Studds Accessories Ltd.’s initial public offering (IPO) began on October 30, 2025, and will end on November 3, 2025. Investors responded enthusiastically to the issuance at the conclusion of the second day, with a total of 5.08 subscriptions. While (NIIs) booked 9.62 times, the retail segment was subscribed to 6.03 times. At 0.04 times, the (QIBs) showed low engagement. The robust demand from high-net-worth and retail investors demonstrates faith in Studds’ standing as a significant force in the automobile accessory industry.

NFOs

LIC MF Consumption Growth Direct Plan: The fund concentrates on India’s burgeoning middle class, rising earnings, and urbanization. It intends to invest primarily (between 80 and 100%) in stocks, with a significant amount going to businesses that will profit from this increase in consumption.

Axis Income Plus Arbitrage Passive FoF Growth Direct Plan: This fund combines arbitrage funds with passive debt schemes to produce returns that are comparatively stable and less risky. It is a good option for cautious investors looking for greater post-tax efficiency than conventional debt options because it offers simple liquidity, no exit load, and a modest entry amount.

Growth Direct Plan for the Nifty Midcap 150 Index: This index fund provides diversified exposure to India’s mid-cap market by mirroring the NIFTY Midcap 150 Total Return Index. Long-term investors who are willing to take on more risk in exchange for possible gain will find it appealing, and they will also profit from reduced expenses and increased transparency.

Direct Plan for Qsif Equity Ex’s Top 100 Long Short Growth: Using long-short derivative methods and investing in companies outside of the top 100 market-cap equities, this fund takes an alternative equity approach. It is intended for investors looking for distinctive opportunities outside of large-cap equities using a more flexible investment approach.

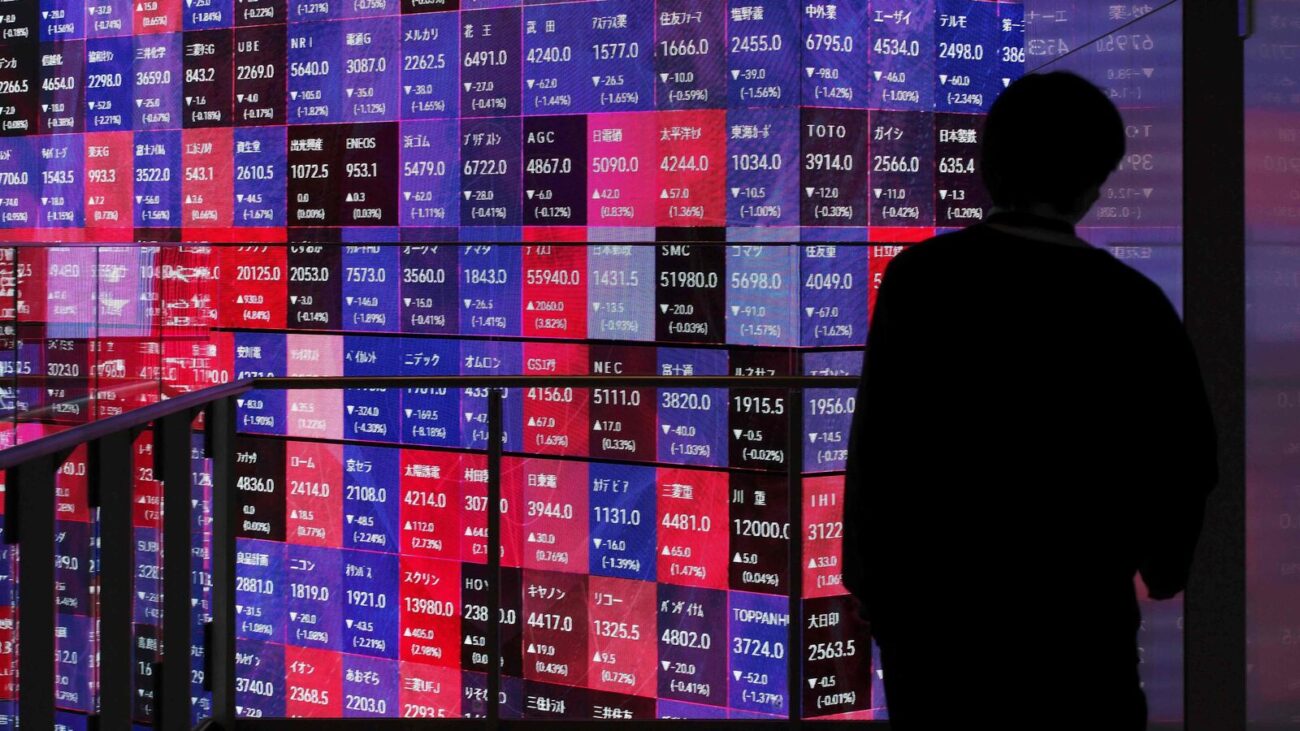

That is a wrap on the news for the week ended October 31st. Let’s have a look at how the markets responded and actually moved this week, from indices and mutual funds to stocks and what fellow investors on Kuvera were watching. Let’s dig into the market movers to see how it all played out.

Kuvera is a free direct mutual fund investing platform. Unless otherwise stated data sourced from BSE, NSE and kuvera.